DLF Limited, India’s largest real estate company, has long been a key player in the country’s booming property market. Whether you are a seasoned investor or a newcomer to the stock market, understanding the intricacies of DLF’s stock price can provide you with valuable insights into the broader real estate market. This article delves deep into the factors affecting DLF’s stock price, historical trends, and future projections, while also answering frequently asked questions (FAQs) to help guide potential investors.

Overview of DLF Limited

Founded in 1946 by Chaudhary Raghvendra Singh, DLF (Delhi Land & Finance) started its journey with the development of 22 urban colonies in Delhi. Over the years, DLF has established itself as a real estate juggernaut with a presence in multiple sectors, including residential, commercial, and retail developments across India.

DLF’s portfolio includes luxury homes, business parks, retail spaces, and commercial towers. It is particularly known for its role in developing Gurgaon (now Gurugram), one of India’s largest real estate hubs. Today, DLF operates in over 15 states and 24 cities in India, further diversifying into areas like infrastructure, utilities, and financial services.

Factors Affecting DLF Stock Price

1. Macroeconomic Conditions

Real estate is a highly cyclical industry, and DLF’s stock price is sensitive to macroeconomic factors. Interest rates, inflation, and GDP growth play a crucial role in shaping the real estate market. For instance, higher interest rates can lead to higher mortgage rates, reducing the demand for housing, thereby affecting DLF’s revenue.

Similarly, inflation impacts the cost of construction materials, which in turn can impact the company’s profitability. On the contrary, a booming economy increases disposable income, driving demand for housing and commercial properties, which positively affects the stock price.

2. Government Policies and Regulations

India’s real estate sector has been subject to various reforms in recent years. Regulations like the Real Estate (Regulation and Development) Act, 2016 (RERA) have increased transparency and accountability in the real estate sector. While these regulations protect consumers, they also impose strict timelines and compliance costs on developers like DLF, influencing their earnings and stock prices.

Other government initiatives, such as the introduction of the Goods and Services Tax (GST) and the Pradhan Mantri Awas Yojana (PMAY), also affect the real estate sector by providing incentives for affordable housing and easing the tax burden on property buyers and developers.

3. Project Launches and Sales

DLF’s stock price often responds to its project launches and sales performance. Successful launches in high-demand areas can boost investor confidence, while any delays or cancellations can result in a drop in the stock price. DLF’s premium projects, like the luxury residential developments in Gurugram, play a crucial role in shaping its stock performance.

DLF regularly reports its sales figures during quarterly earnings calls, and any uptick in sales is typically reflected positively in its stock price. Investors closely monitor sales data to gauge future cash flows and the company’s ability to maintain profitability.

4. Financial Performance

The company’s financial health is an essential determinant of its stock price. Metrics such as revenue, net income, and debt levels are crucial indicators of its performance. DLF’s stock price is particularly sensitive to quarterly earnings reports, which provide insights into profitability and operational efficiency.

DLF’s debt levels have historically been a point of concern for investors. High leverage can increase financial risk, particularly in an environment of rising interest rates. However, in recent years, DLF has taken steps to deleverage its balance sheet, a move that has been welcomed by investors.

5. Market Sentiment

Like any stock, DLF is also impacted by broader market sentiment. Investor perceptions, news about the real estate sector, and even global market conditions can lead to price fluctuations. During periods of economic uncertainty, investors tend to be more risk-averse, leading to a sell-off in stocks like DLF that are perceived to be cyclical or volatile.

Similarly, positive news, such as the government’s push for infrastructure development or a favorable earnings report, can lift market sentiment and drive the stock price higher.

6. Global Economic Factors

Real estate is no longer just a local or national market. Global economic conditions can also impact DLF’s stock price, especially since the company caters to a global investor base. Factors like currency exchange rates, international interest rates, and global investment trends can have an indirect effect on the stock price.

For instance, an economic slowdown in global markets could lead to reduced Foreign Direct Investment (FDI) in India, affecting the commercial and residential real estate sectors, thus influencing DLF’s stock performance.

Historical Performance of DLF Stock

DLF made its Initial Public Offering (IPO) in 2007, raising a record $2.24 billion, making it one of the largest IPOs in Indian corporate history at the time. Since its listing, DLF has experienced significant volatility in its stock price, reflecting the cyclical nature of the real estate market.

2007-2008: Initial Surge and Subsequent Decline

Following its IPO, DLF’s stock surged to an all-time high of around INR 1,200 per share. However, the global financial crisis of 2008 took a toll on real estate stocks worldwide, and DLF was no exception. The stock price plummeted as the global credit crunch hurt the real estate market, and by early 2009, DLF’s stock had fallen below INR 200.

2010-2015: Slow Recovery and Consolidation

Post-2008, DLF experienced a slow but steady recovery. The Indian economy rebounded, and the stock price gradually climbed back. However, the real estate sector faced several challenges during this period, including policy changes, regulatory hurdles, and rising interest rates, leading to consolidation in the market.

2016-2019: Regulatory Reforms and New Projects

The introduction of RERA in 2016 had a significant impact on the real estate sector, making the market more organized and transparent. While these reforms benefited consumers, they created challenges for developers in terms of compliance and project timelines. DLF’s stock showed resilience during this time, buoyed by new project launches and a gradual improvement in market sentiment.

2020-Present: Pandemic and Recovery

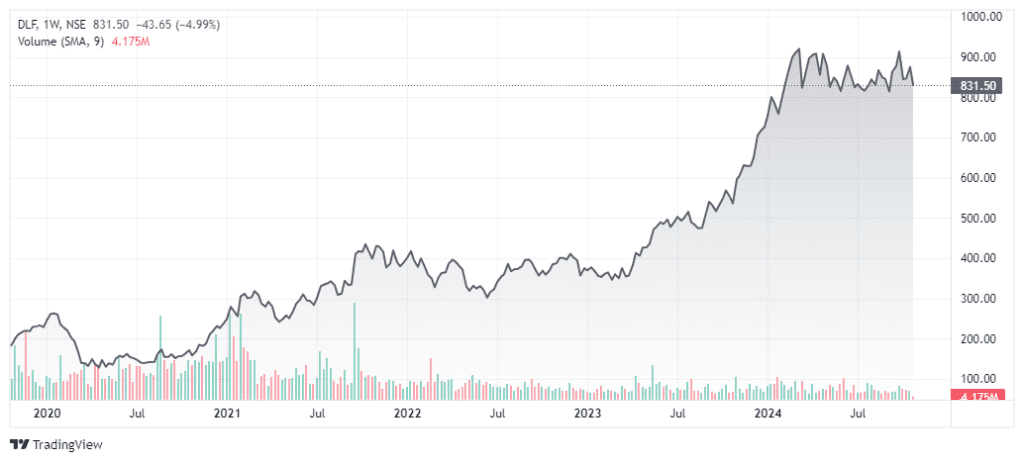

The COVID-19 pandemic in 2020 severely impacted the real estate sector, causing DLF’s stock to drop as markets went into freefall. However, the company quickly rebounded due to increased demand for housing, particularly in suburban areas. Additionally, lower interest rates and government stimulus packages boosted the real estate market, resulting in a sharp recovery in DLF’s stock price.

As of 2024, DLF’s stock is trading at a range that reflects a more stable and optimistic outlook for the real estate sector in India, particularly in high-growth areas like Gurugram and Bengaluru.

Future Prospects of DLF Stock

Looking ahead, several factors will determine the future trajectory of DLF’s stock price:

- Urbanization and Housing Demand: India is witnessing rapid urbanization, which will continue to drive demand for housing and commercial properties. DLF, with its established brand and strong portfolio, is well-positioned to capitalize on this trend.

- Expansion into Tier-2 and Tier-3 Cities: DLF has already begun expanding its footprint into smaller cities, where real estate demand is rising. These new markets could provide the company with significant growth opportunities in the coming years.

- Sustainability and Green Buildings: The global shift towards sustainable development and green buildings could also benefit DLF, which has been focusing on developing environmentally friendly projects.

- Deleveraging Efforts: DLF’s efforts to reduce its debt levels will likely have a positive impact on its stock price, as a healthier balance sheet reduces financial risk and increases investor confidence.

- Technological Adoption: The adoption of new technologies, such as PropTech (Property Technology), is transforming the real estate sector. DLF’s ability to integrate technology into its operations, from project management to customer engagement, will be crucial for future growth.

- Impact of Interest Rates: The direction of interest rates will continue to play a significant role in determining housing affordability and overall real estate demand. A favorable interest rate environment will be critical for sustaining high levels of demand for DLF’s properties.

FAQ: DLF Stock Price

1. What is the current DLF stock price?

The current stock price of DLF fluctuates throughout the trading day. You can check the real-time stock price on stock market platforms like the Bombay Stock Exchange (BSE) or National Stock Exchange (NSE), as well as on financial websites like Moneycontrol, NSE India, or Bloomberg.

2. Is DLF stock a good investment?

DLF is a leading player in the real estate market with a strong brand and diversified portfolio. However, like any stock, investing in DLF comes with risks. It is essential to consider your investment horizon, risk tolerance, and the overall state of the real estate market before investing in DLF.

3. What are the risks associated with investing in DLF stock?

The key risks include macroeconomic factors such as interest rates, inflation, and economic slowdowns. Additionally, regulatory changes, project delays, and high debt levels could negatively impact DLF’s stock price.

4. How has DLF’s stock performed historically?

Since its IPO in 2007, DLF has experienced significant volatility, with highs and lows reflecting the cyclical nature of the real estate market. The stock reached an all-time high post-IPO, followed by a sharp decline during the global financial crisis of 2008. In recent years, it has shown resilience and recovery, particularly post-COVID-19.

5. What factors should I consider before buying DLF stock?

Before buying DLF stock, consider factors such as the company’s financial performance, debt levels, project pipeline, macroeconomic conditions, and market sentiment towards the real estate sector.

6. What is DLF’s dividend policy?

DLF has a history of paying dividends to its shareholders. However, the dividend amount and frequency may vary based on the company’s financial performance and overall market conditions.

7. How does DLF compare to other real estate stocks in India?

DLF is the largest real estate company in India by market capitalization and has a more diversified portfolio compared to many of its competitors. While other real estate companies may focus on niche segments or specific geographies, DLF operates across multiple sectors and regions, giving it a competitive advantage.

8. How can I buy DLF stock?

DLF stock can be purchased through stockbrokers, both online and offline. It is listed on the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE) under the ticker symbol “DLF.” To buy the stock, you’ll need a Demat account linked to a trading platform.

9. What is the outlook for DLF’s stock price?

The outlook for DLF’s stock price depends on several factors, including economic growth, interest rates, real estate demand, and the company’s financial health. While the stock has shown resilience in recent years, investors should remain cautious of potential risks, particularly macroeconomic challenges.

DLF remains a formidable force in the Indian real estate market. Its stock price reflects both the inherent opportunities and risks within the sector. With a strong brand, a diverse project portfolio, and a focus on sustainable growth, DLF presents an intriguing investment option for those looking to capitalize on India’s real estate boom. However, like any investment, it requires careful consideration of the factors affecting the market and the company’s performance.

Chirag Singh is a content writer with a focus on real estate, covering topics like News, Guidance, Tips, Property trends and Investments. He has written for various platforms, providing helpful insights to readers. With a background in real estate, Chirag combines his knowledge and passion for real estate in his work. He enjoys staying updated on the latest industry trends.