Introduction

In the dynamic world of real estate, Godrej Properties Limited stands out as one of the prominent players. Established in 1990 as part of the renowned Godrej Group, it has grown into a major real estate developer, known for innovation, sustainability, and quality. The company has been involved in multiple residential, commercial, and township projects across major cities in India. Investors interested in real estate stocks often keep a close eye on Godrej Properties’ share price, given its standing in the industry.

In this article, we will provide a comprehensive overview of Godrej Properties’ share price, exploring the company’s background, financial performance, stock market trends, and key factors influencing its share price. We’ll also cover frequently asked questions to offer better insights into investing in this stock.

Understanding Godrej Properties

Godrej Properties Limited (GPL) is part of the Godrej Group, one of India’s oldest and most trusted conglomerates. The company operates in the real estate sector, focusing on residential, commercial, and township developments. With a reputation for quality, customer satisfaction, and innovation, Godrej Properties has a strong brand presence.

The company has developed a number of landmark projects across major cities in India, such as Mumbai, Bangalore, Pune, Kolkata, and Delhi-NCR. Its portfolio includes luxurious residential projects, office spaces, and premium commercial properties.

Why is Godrej Properties a Popular Investment Option?

- Strong Brand Value: The Godrej brand is synonymous with trust and quality, and its real estate division carries this legacy forward. Investors often gravitate towards companies with well-established brand identities.

- Consistent Performance: Over the years, Godrej Properties has consistently delivered projects, meeting both quality and time commitments. This performance translates into trust, which reflects positively in its stock price.

- Urbanization Trends: India’s urbanization rate is growing rapidly, with more people moving to cities for better opportunities. Godrej Properties’ strategic focus on urban real estate development is well-positioned to capitalize on this trend.

- Sustainability and Innovation: Godrej Properties is known for its eco-friendly practices and sustainable development. It has introduced several innovations in real estate development, making it a favorite among investors who are environmentally conscious.

- Diverse Portfolio: The company has a well-diversified portfolio across residential and commercial projects, reducing the risk of dependence on any single segment.

Factors Affecting Godrej Properties Share Price

Like any publicly traded company, Godrej Properties’ share price is influenced by a wide range of factors, including the company’s financial performance, industry trends, government policies, macroeconomic conditions, and investor sentiment. Below are some of the primary factors impacting the share price of Godrej Properties:

1. Financial Performance

The company’s quarterly and annual financial results play a significant role in determining its stock price. Key metrics such as revenue, profit margins, debt levels, and project completion rates are closely monitored by investors. Consistently strong earnings reports usually lead to positive movements in the share price, while underperformance or missed targets can cause a decline.

2. Market Sentiment and Investor Behavior

Stock prices are highly influenced by market sentiment. Investor perception of the real estate market, coupled with general market trends, can impact Godrej Properties’ share price. Positive sentiment in the broader market often results in increased buying activity, pushing up stock prices, while negative sentiment can have the opposite effect.

3. Interest Rates and Lending Policies

The real estate sector is sensitive to changes in interest rates and lending policies. A rise in interest rates can make home loans and real estate investments more expensive for buyers, potentially slowing down property sales. On the other hand, when interest rates are low, real estate demand typically increases, benefiting companies like Godrej Properties.

4. Government Policies

Government regulations, such as changes in the Goods and Services Tax (GST), the Real Estate Regulatory Authority (RERA), or housing policies, can significantly impact the real estate market. Policies that favor affordable housing, reduce red tape, or offer incentives for homebuyers can boost demand and improve investor sentiment for real estate companies, including Godrej Properties.

5. Real Estate Market Trends

Real estate market trends, both in India and globally, play a critical role in influencing stock prices. The demand for residential and commercial properties, pricing trends, and the availability of land in key locations are crucial for the company’s growth. Investors watch these trends to gauge the future prospects of the company.

6. Competition

Godrej Properties operates in a competitive environment with numerous other developers, such as DLF, Oberoi Realty, and Prestige Estates. Competitive pricing, innovations, and the ability to secure prime land affect the company’s market share, which, in turn, influences the stock price.

7. Global Economic Factors

Global factors like inflation, crude oil prices, and economic growth rates affect real estate companies. For instance, inflation can drive up the cost of raw materials, increasing the cost of construction. Meanwhile, a strong economy generally leads to increased disposable income, encouraging real estate investments.

8. Project Launches and Completions

Godrej Properties’ share price is often sensitive to announcements regarding new project launches, project sales, and completion timelines. Timely delivery of projects and successful sales launches can lead to a positive response from investors.

Godrej Properties Share Price Trends

The performance of Godrej Properties’ stock has historically been influenced by the above factors. Here’s an analysis of the share price trends over recent years:

Pre-COVID Performance

Before the COVID-19 pandemic, Godrej Properties had seen consistent growth in its stock price, driven by strong financial results, project launches, and rising demand for housing in major Indian cities. The company’s focus on delivering premium residential and commercial projects contributed to a steady increase in its stock price.

COVID-19 Impact

The pandemic brought a temporary halt to construction activities and affected property sales. The real estate sector, including Godrej Properties, saw a significant dip in stock prices during the initial months of the pandemic. However, the company quickly adapted to the new normal by ramping up digital sales platforms and focusing on affordable housing, which led to a gradual recovery in its share price.

Post-COVID Recovery

As the real estate sector started recovering post-pandemic, Godrej Properties witnessed a rebound in demand for residential properties, particularly in tier-1 and tier-2 cities. The share price of Godrej Properties saw a significant rise, reflecting the renewed optimism in the sector. The company’s focus on premium and luxury housing has kept its stock attractive to investors.

Investing in Godrej Properties

Investing in real estate stocks, including Godrej Properties, can be a rewarding venture. However, it’s important to consider your risk tolerance and investment horizon. Real estate stocks are often subject to market volatility, and their performance can be impacted by various external factors.

Here are some key considerations for potential investors in Godrej Properties:

- Long-term Investment: Real estate stocks are generally more suitable for long-term investors, as the real estate cycle can take time to unfold. If you have a long-term investment horizon, Godrej Properties could be a good addition to your portfolio.

- Diversification: If you’re already invested in other sectors, adding real estate stocks can help diversify your portfolio and reduce risk. Godrej Properties offers exposure to the Indian real estate market, which could provide stability over the long run.

- Dividend Income: Godrej Properties has a history of paying dividends, making it attractive to income-focused investors. However, dividend payouts can vary based on the company’s performance and market conditions.

- Growth Potential: The company’s strong brand, focus on innovation, and presence in key urban markets offer significant growth potential. As urbanization continues in India, Godrej Properties is well-positioned to benefit from increased demand for housing and commercial spaces.

- Risks: Like any investment, there are risks associated with investing in Godrej Properties. These include market volatility, regulatory changes, interest rate fluctuations, and competition from other developers. It’s essential to conduct thorough research or consult a financial advisor before making investment decisions.

Frequently Asked Questions (FAQ)

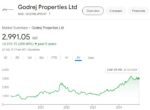

Q1. What is the current share price of Godrej Properties?

The share price of Godrej Properties fluctuates based on market conditions. You can check the live stock price on the Bombay Stock Exchange (BSE) or National Stock Exchange (NSE) or through a financial news platform.

Q2. Is Godrej Properties a good stock to invest in?

Godrej Properties has a strong brand and a solid track record in the Indian real estate sector. It is considered a good investment option for long-term investors, especially those looking for exposure to the real estate market. However, stock performance can be volatile, and it’s essential to do thorough research before investing.

Q3. How has Godrej Properties performed financially?

The company’s financial performance has been strong over the years, with consistent revenue growth and profitability. However, like any real estate company, it faces risks such as regulatory changes and economic downturns, which can impact financial performance.

Q4. What factors affect the share price of Godrej Properties?

The share price of Godrej Properties is influenced by multiple factors, including financial performance, market sentiment, real estate demand, interest rates, and government policies. Project launches, sales, and completion timelines also play a significant role.

Q5. Does Godrej Properties pay dividends?

Yes, Godrej Properties has a history of paying dividends. The amount and frequency of dividends depend on the company’s financial performance and market conditions.

Q6. What are the risks of investing in Godrej Properties?

The primary risks include market volatility, interest rate changes, competition from other developers, regulatory changes, and macroeconomic factors. The real estate sector is also cyclical, so there may be periods of slower growth or declining demand.

Q7. How can I invest in Godrej Properties?

You can invest in Godrej Properties by purchasing its shares through a brokerage account. The company is listed on both the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE). Ensure you have a Demat account before making any stock purchases.

Q8. What are the future growth prospects for Godrej Properties?

Godrej Properties is well-positioned to benefit from India’s urbanization trends and the growing demand for housing and commercial spaces. The company’s focus on sustainable and innovative projects also gives it an edge in the market.

Conclusion

Godrej Properties has established itself as a leading player in the Indian real estate sector. Its stock has consistently attracted investors due to the company’s strong brand, diversified portfolio, and commitment to innovation. Like any investment, it’s important to weigh the potential risks and rewards, conduct thorough research, and consider your own financial goals before making a decision.

Investing in real estate stocks, including Godrej Properties, can offer long-term growth potential, particularly in a country like India, where urbanization is on the rise.

Chirag Singh is a content writer with a focus on real estate, covering topics like News, Guidance, Tips, Property trends and Investments. He has written for various platforms, providing helpful insights to readers. With a background in real estate, Chirag combines his knowledge and passion for real estate in his work. He enjoys staying updated on the latest industry trends.