House tax, also known as property tax, is a tax levied on property owners by municipal authorities. In Delhi, this tax is managed by the Municipal Corporation of Delhi (MCD), and it is applicable to all types of properties, including residential, commercial, industrial, and vacant land. Let’s explore in detail whether it is mandatory to pay house tax in Delhi and why it is important.

What Is House Tax?

House tax is an annual tax imposed by the government on property owners. It is used to fund essential public services like:

- Road maintenance

- Street lighting

- Waste management

- Parks and public facilities

Paying house tax ensures the smooth functioning of civic amenities in your locality.

Is It Mandatory to Pay House Tax in Delhi?

Yes, paying house tax in Delhi is mandatory for property owners. As per the regulations of the Delhi Municipal Corporation Act, 1957, every property owner in Delhi is legally required to pay house tax annually. Failure to do so can lead to penalties, legal action, and even the attachment of the property by the municipal authorities.

Who Needs to Pay House Tax?

The following categories of property owners are required to pay house tax:

- Residential Property Owners – Anyone owning a house, apartment, or flat.

- Commercial Property Owners – Shops, offices, and commercial buildings.

- Industrial Property Owners – Factories and industrial setups.

- Vacant Land Owners – Land that is not currently in use.

Exemptions: Certain properties, such as religious places, burial grounds, or government properties, may be exempt from house tax.

How Is House Tax Calculated in Delhi?

The house tax in Delhi is calculated based on the Unit Area System (UAS), which considers:

- Annual Value (AV) – The expected rent a property can fetch annually.

- Location – Properties in posh areas have higher tax rates.

- Property Use – Residential or commercial.

- Property Size – Larger properties attract higher taxes.

- Age of Property – Older properties may have lower tax rates.

The formula for house tax calculation in Delhi is:

House Tax = Unit Area Value × Property Age Factor × Area Covered × Use Factor × Occupancy Factor

Consequences of Not Paying House Tax

Failing to pay house tax can lead to the following consequences:

- Penalties – A late fee or penalty interest will be added to your dues.

- Legal Action – The MCD can file a legal case against you.

- Property Seizure – Authorities can attach or auction the property to recover dues.

How to Pay House Tax in Delhi?

You can pay your house tax online or offline.

1. Online Payment

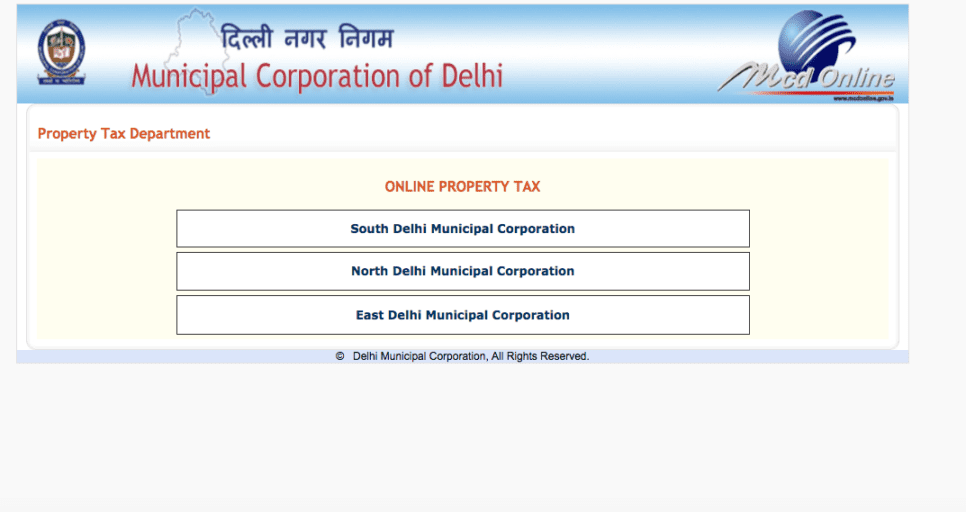

Visit the official MCD website:

- Go to https://mcdonline.nic.in/

- Select the property tax section.

- Enter your Property ID.

- Verify the details and calculate the tax.

- Make the payment through net banking, credit card, or debit card.

2. Offline Payment

You can visit your nearest MCD office and pay the tax in person. Carry the necessary documents, such as:

- Property ID

- Previous tax receipts

- Ownership proof

Benefits of Paying House Tax

- Avoid Legal Issues – Ensures compliance with legal requirements.

- Property Record Maintenance – Maintains clear ownership records.

- Access to Civic Services – Ensures continued services like waste disposal, water supply, etc.

- Increases Property Value – Properties with a clear tax record are easier to sell.

Common Questions About House Tax in Delhi

1. Can I pay house tax in installments?

Yes, MCD allows property owners to pay taxes in installments. Check the website or visit an office for details.

2. Are there any rebates on house tax?

Senior citizens, women, and differently-abled individuals may receive rebates. Check eligibility criteria on the MCD website.

3. What happens if I overpay house tax?

Overpaid amounts are adjusted in future payments or refunded upon request.

Conclusion

Paying house tax in Delhi is not just mandatory but also a responsibility toward maintaining civic infrastructure. By paying your house tax on time, you contribute to the betterment of your locality and avoid legal complications. If you own a property in Delhi, ensure you calculate and pay your house tax annually through the MCD’s convenient online or offline methods.

Chirag Singh is a content writer with a focus on real estate, covering topics like News, Guidance, Tips, Property trends and Investments. He has written for various platforms, providing helpful insights to readers. With a background in real estate, Chirag combines his knowledge and passion for real estate in his work. He enjoys staying updated on the latest industry trends.