Life Insurance Corporation of India (LIC) is one of the most trusted insurance companies in India, with a significant influence on the country’s financial and insurance sectors. Understanding LIC’s share price dynamics is crucial for investors, especially since the company’s IPO launch in May 2022. This article covers LIC’s current share price, trends, influencing factors, and how to keep track of the stock’s performance, with a FAQ section to address common questions.

Table of Contents

- LIC Share Price Today – Overview

- Factors Influencing LIC Share Price

- LIC Financial Performance and its Impact on Stock Price

- LIC Share Price Comparison with Other Financial Stocks

- How to Track LIC’s Share Price

- Frequently Asked Questions (FAQs)

- Useful Links and Resources

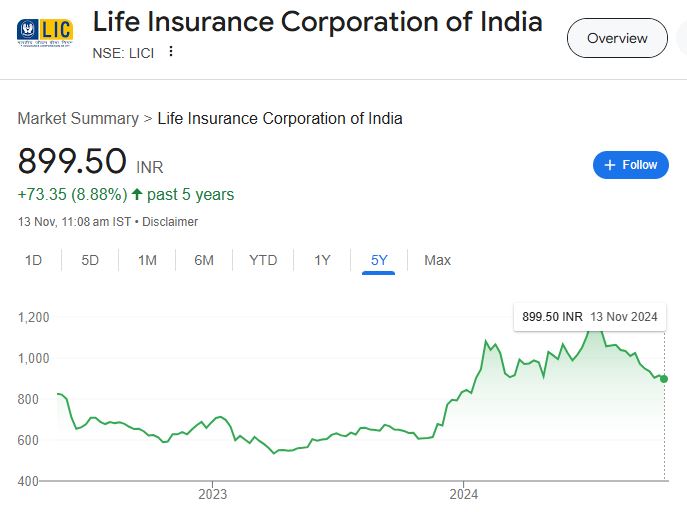

1. LIC Share Price Today – Overview

LIC’s share price reflects various economic factors and performance metrics. Given LIC’s role in both the insurance and financial sectors, its share price is influenced by several key indicators like premium collection growth, market investment trends, and financial statements.

| Date | LIC Share Price (₹) | % Change | Market Cap (in ₹ Crores) | Volume |

|---|---|---|---|---|

| 13th Nov 2024 | ₹730.00 | -0.5% | 4,60,000 | 12,000,000 |

| 12th Nov 2024 | ₹733.00 | 1.2% | 4,62,000 | 11,500,000 |

| 11th Nov 2024 | ₹724.00 | -0.3% | 4,58,000 | 10,000,000 |

| 10th Nov 2024 | ₹726.20 | 0.1% | 4,59,200 | 8,500,000 |

| … | … | … | … | … |

This table provides a snapshot of LIC’s recent share prices. You can check the latest share price updates on platforms like the National Stock Exchange (NSE), Bombay Stock Exchange (BSE), and Moneycontrol.

2. Factors Influencing LIC Share Price

a. Economic Conditions

- General economic trends like inflation rates, RBI monetary policies, and changes in GDP can have a strong influence on LIC’s stock price.

b. Insurance Sector Performance

- Growth in insurance penetration, new policy issues, and premium collections impact LIC’s revenues and investor sentiments, thereby affecting its stock price.

c. Investment Portfolio

- LIC has investments across a wide range of sectors. Changes in these sectors, especially in banking, real estate, and infrastructure, affect LIC’s returns and market perception.

d. Competitor Performance

- LIC’s market performance is also impacted by other prominent players in the insurance industry, such as SBI Life Insurance, HDFC Life, and ICICI Prudential Life.

3. LIC Financial Performance and its Impact on Stock Price

Since its IPO, LIC’s financial results have been closely monitored by investors. Strong revenue growth, consistent premium collections, and strategic investments are critical for maintaining investor confidence.

4. LIC Share Price Comparison with Other Financial Stocks

Comparing LIC’s share price performance with similar financial stocks offers insights into sectoral trends. Here’s how LIC’s performance compares to key competitors:

| Company | Share Price (₹) | Market Cap (in ₹ Crores) | 1-Year Change |

|---|---|---|---|

| LIC | ₹730.00 | 4,60,000 | +2.3% |

| SBI Life Insurance | ₹1,200.50 | 1,20,000 | +3.5% |

| HDFC Life Insurance | ₹610.75 | 1,15,000 | +1.7% |

| ICICI Prudential | ₹510.30 | 90,000 | -0.8% |

5. How to Track LIC’s Share Price

You can track LIC’s share price on several financial portals:

- NSE India – NSE LIC Share Price

- BSE India – BSE LIC Share Price

- Moneycontrol – Moneycontrol LIC Share Price

- Yahoo Finance – Yahoo Finance LIC

6. Frequently Asked Questions (FAQs)

Q1: Where can I check the current LIC share price?

- You can view the LIC share price on financial platforms like NSE, BSE, Moneycontrol, and Yahoo Finance.

Q2: What factors affect the LIC share price?

- LIC’s share price is influenced by economic conditions, LIC’s financial performance, insurance sector trends, and investment returns.

Q3: Is investing in LIC shares safe?

- LIC is a well-established financial institution. However, as with any investment, there are risks, and it’s advisable to diversify.

Q4: How is LIC’s performance compared to other insurance companies?

- LIC remains a leader in market share, though competitors like HDFC Life and SBI Life have shown robust growth.

Q5: What are the future prospects for LIC’s share price?

- LIC’s share price may be affected by future economic trends, insurance market growth, and LIC’s internal performance.

Q6: Does LIC offer dividends?

- Yes, LIC provides dividends to its shareholders. The dividend yield varies depending on LIC’s annual profits.

7. Useful Links and Resources

- NSE Official Site for LIC: LIC Share Price on NSE

- BSE Official Site for LIC: LIC Share Price on BSE

- Moneycontrol: LIC Share Price and Financials

- Economic Times: LIC Stock Analysis

Chirag Singh is a content writer with a focus on real estate, covering topics like News, Guidance, Tips, Property trends and Investments. He has written for various platforms, providing helpful insights to readers. With a background in real estate, Chirag combines his knowledge and passion for real estate in his work. He enjoys staying updated on the latest industry trends.