Oberoi Realty Share Price

Introduction

Oberoi Realty Share Price is one of the leading real estate developers in India, with a strong presence in Mumbai’s luxury housing, commercial, retail, and hospitality segments. As a publicly listed company on the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE), its stock performance has garnered significant attention from investors.

In this article, we’ll delve into the details of Oberoi Realty’s share price, factors influencing its stock, recent performance trends, and frequently asked questions (FAQs) to provide a clear understanding of this investment option.

Understanding Oberoi Realty Share Price

The share price of Oberoi Realty reflects the market’s perception of the company’s performance, growth prospects, and the overall sentiment toward the real estate sector. Real estate stocks are influenced by both company-specific factors and broader economic and market trends. Here, we’ll explore some of the key aspects that affect Oberoi Realty’s stock price.

1. Company Overview

Founded in 1998, Oberoi Realty has established a strong reputation for delivering high-quality projects across residential, commercial, and hospitality sectors. The company’s focus has been on premium residential properties, with landmark projects in prime locations in Mumbai. As of 2023, Oberoi Realty’s portfolio comprises over 40 completed projects, with a total of 11.89 million sq. ft. of built-up area.

The company’s strong brand equity, high customer satisfaction, and focus on luxury have made it a favored choice among real estate investors. The stock of Oberoi Realty trades on both the BSE and NSE under the ticker symbol “OBEROIRLTY.”

2. Share Price Performance

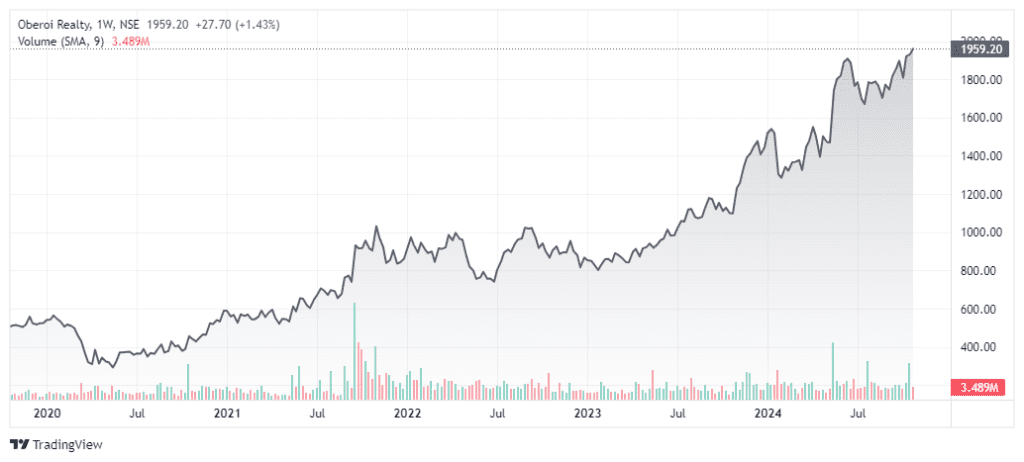

Oberoi Realty’s share price has seen considerable movement in the last few years. Historically, real estate stocks tend to be volatile due to the cyclical nature of the real estate market and external factors such as economic conditions, interest rates, government policies, and market sentiment.

In recent years, Oberoi Realty has benefited from:

- A strong demand for luxury housing in Mumbai.

- The government’s support for infrastructure development.

- Urbanization trends.

These factors have positively influenced Oberoi Realty’s financial performance, resulting in stock price appreciation.

3. Key Financials

A company’s financial health is one of the most significant factors affecting its stock price. Let’s break down some of the most important financial metrics for Oberoi Realty:

- Revenue Growth: Oberoi Realty has consistently shown robust revenue growth due to its strong pipeline of residential and commercial projects. The company reported a 25% increase in consolidated revenue for FY23, with residential sales being the primary driver.

- Profit Margins: The company’s net profit margin has been consistently high, reflecting its ability to control costs and maximize profitability.

- Debt Levels: Oberoi Realty has maintained a conservative debt profile, ensuring a healthy balance sheet. This low leverage ratio has been favorable in terms of investor confidence.

- Earnings Per Share (EPS): Oberoi Realty’s EPS is a key measure of its profitability. A consistent increase in EPS has contributed to upward movement in the share price over time.

4. Key Factors Influencing Oberoi Realty Share Price

Several factors can influence the share price of Oberoi Realty, both internal and external. Here are some of the primary elements that investors should be aware of:

- Real Estate Market Conditions: The real estate market is highly cyclical, with periods of growth followed by slowdowns. When demand for housing and commercial properties rises, Oberoi Realty benefits from increased sales and profitability, which positively impacts its stock price.

- Government Policies: Government initiatives such as the Real Estate (Regulation and Development) Act (RERA), tax incentives, and affordable housing schemes can have a significant effect on the real estate sector, including Oberoi Realty. Positive regulatory changes often lead to stock price appreciation.

- Economic Indicators: Interest rates, inflation, and GDP growth are crucial economic indicators that can impact the real estate market. For example, lower interest rates make home loans more affordable, leading to higher demand for residential properties.

- Project Pipeline: Oberoi Realty’s ability to execute and deliver projects on time is critical to its financial success. A strong pipeline of projects ensures consistent revenue and profit growth, supporting its stock price.

- Investor Sentiment: Like all stocks, Oberoi Realty’s share price is influenced by market sentiment. Positive news, such as new project launches or higher-than-expected earnings, can lead to a surge in the stock price, while negative news can result in a decline.

5. Recent Share Price Trends

In 2023, Oberoi Realty’s share price saw steady growth, driven by several factors:

- Strong residential demand in Mumbai, particularly in luxury housing.

- The launch of new projects.

- Solid quarterly results, reflecting high sales volume and profitability.

However, like other stocks, Oberoi Realty also faced some volatility due to global economic uncertainties, inflation concerns, and market corrections. Despite these challenges, the company’s focus on premium projects and a robust balance sheet helped it maintain a stable position in the market.

Investing in Oberoi Realty: Key Considerations

Investors looking to invest in Oberoi Realty’s stock should consider both the potential risks and rewards. Here are some factors to keep in mind:

1. Long-Term Growth Potential

Oberoi Realty’s strong brand reputation, focus on luxury properties, and a growing portfolio in Mumbai’s prime locations make it an attractive investment option for long-term investors. The company has a robust pipeline of projects, ensuring steady revenue and profit growth.

2. Dividend Policy

Oberoi Realty has a consistent dividend-paying history, making it a good choice for income-focused investors. The company’s ability to maintain high profit margins and cash flows supports its dividend payouts.

3. Risk Factors

Investing in real estate stocks comes with inherent risks, including market fluctuations, regulatory changes, and economic downturns. For Oberoi Realty, risks include:

- Any slowdown in the real estate market could negatively impact its revenue.

- Delays in project execution or approvals could affect cash flow.

- Rising interest rates could dampen housing demand.

4. Valuation

When investing in Oberoi Realty, it’s essential to evaluate its stock price relative to its earnings (Price-to-Earnings ratio), book value, and industry peers. Investors should compare these valuation metrics to assess whether the stock is trading at a fair price or is overvalued/undervalued.

Frequently Asked Questions (FAQs) on Oberoi Realty Share Price

1. What is the current Oberoi Realty share price?

The share price of Oberoi Realty fluctuates regularly based on market conditions and trading activity. Investors can check the latest price on financial platforms such as the NSE, BSE, or any stock market app.

2. What factors influence Oberoi Realty’s share price?

Several factors can affect Oberoi Realty’s share price, including real estate market conditions, economic indicators, government policies, project performance, and investor sentiment.

3. How has Oberoi Realty’s share price performed in recent years?

Oberoi Realty’s share price has generally shown an upward trend in recent years, driven by strong demand for luxury housing, steady revenue growth, and solid project execution. However, like all stocks, it has experienced periods of volatility due to external factors such as global economic conditions.

4. Is Oberoi Realty a good investment for the long term?

Oberoi Realty can be a good long-term investment for those looking to gain exposure to the real estate sector, particularly in the luxury segment. The company’s strong brand, robust financials, and growing project portfolio make it an attractive option for long-term growth.

5. Does Oberoi Realty pay dividends?

Yes, Oberoi Realty has a consistent track record of paying dividends to its shareholders. The company’s ability to generate strong cash flows supports its dividend payouts, making it a good option for income-focused investors.

6. What risks should investors consider when investing in Oberoi Realty?

Investors should be aware of several risks when investing in Oberoi Realty, including:

- Market fluctuations in the real estate sector.

- Economic downturns affecting housing demand.

- Regulatory changes or government policies that could impact the industry.

- Interest rate hikes, which may reduce housing affordability.

7. What are some key financial metrics to look at when analyzing Oberoi Realty?

Some key financial metrics to consider include revenue growth, net profit margin, earnings per share (EPS), debt levels, and return on equity (ROE). Investors should also look at the company’s project pipeline and execution capabilities.

8. How does Oberoi Realty compare with other real estate companies?

Oberoi Realty stands out due to its focus on luxury properties in Mumbai, which gives it a unique position in the market. While other real estate companies may have a broader geographic presence, Oberoi’s focus on premium projects and a strong brand name have helped it maintain high profit margins and steady growth.

9. How can I invest in Oberoi Realty?

Investors can purchase Oberoi Realty shares through any stockbroker or trading platform that provides access to the NSE or BSE. It’s important to conduct thorough research and analysis before making any investment decisions.

10. What is the outlook for Oberoi Realty’s share price?

The outlook for Oberoi Realty’s share price is closely tied to the broader real estate market and economic conditions. As demand for luxury housing in Mumbai continues to grow, the company’s strong project pipeline and financial health suggest that it is well-positioned for future growth. However, external factors such as interest rates and government policies will play a significant role in shaping the stock’s future performance.

Conclusion

Oberoi Realty is a prominent player in the Indian real estate market, particularly in the luxury segment. The company’s stock has performed well over the years, backed by strong financials, a healthy project pipeline, and favorable market conditions. Investors looking to diversify their portfolios with exposure to the real estate sector may find Oberoi Realty an attractive option, provided they are mindful of the associated risks.

As always, it’s important to conduct thorough research, stay updated on market trends, and consult with financial advisors before making any investment decisions.

Chirag Singh is a content writer with a focus on real estate, covering topics like News, Guidance, Tips, Property trends and Investments. He has written for various platforms, providing helpful insights to readers. With a background in real estate, Chirag combines his knowledge and passion for real estate in his work. He enjoys staying updated on the latest industry trends.